For course creators, teachers, and service-based businesses like yoga studios and art classes, managing payments efficiently is crucial for maintaining financial stability. Without a well-defined strategy, payment collection can become time-consuming and stressful, leading to unnecessary administrative work. Implementing effective payment reminder strategies ensures timely payments, reduces administrative burdens, and enhances the student or client experience. A seamless and organized approach to payment reminders not only secures steady revenue but also strengthens trust and professionalism in business relationships. In this guide, we explore proven techniques to optimize your payment reminder system and improve financial workflows.

Why Payment Reminders Matter

Late or missed payments can significantly impact cash flow, making it difficult to cover operational costs and plan for future growth. Many educators and service providers struggle with delayed payments due to a lack of structured reminder systems. A well-structured payment reminder system helps:

- Ensure timely revenue collection, avoiding unnecessary financial strain.

- Reduce the need for manual follow-ups, saving time and effort.

- Maintain positive student and client relationships by keeping communication clear and professional.

- Improve overall financial planning, allowing businesses to make informed decisions about scaling their operations.

By incorporating an effective reminder strategy, businesses can foster a smooth payment process while reducing frustration for both themselves and their clients.

Crafting the Perfect Payment Reminder System

1. Utilize Multiple Communication Channels

Ensuring that students or clients receive and acknowledge payment reminders requires a multi-channel approach. Depending on individual preferences, different communication methods increase the likelihood of prompt payments. Recommended channels include:

- Email: Ideal for detailed payment instructions, including invoices, due dates, and breakdowns of charges.

- SMS: Quick and direct, ensuring that recipients receive the message promptly.

- WhatsApp or Messaging Apps: More personal and engaging, allowing two-way communication for inquiries.

- In-App Notifications: Useful for digital learning and service platforms, reinforcing reminders within existing systems.

Real-World Example: Many service-based businesses, like fitness centers, use SMS to send payment reminders in real-time. For instance, Mindbody provides automated SMS notifications for businesses to keep their clients informed and engaged, ensuring payments are made on time.

A diverse approach ensures that clients do not miss their reminders and can easily access payment details through their preferred method.

2. Automate Your Payment Reminders

Automation eliminates the need for manual tracking and ensures reminders are sent at optimal times without the risk of human oversight. Flowclass offers automation tools that:

- Schedule reminders for specific intervals, reducing manual intervention.

- Send personalized messages that cater to different client segments.

- Track payment statuses efficiently, providing real-time updates on outstanding balances.

With automation, businesses can focus on delivering quality services rather than spending excessive time chasing payments.

Real-World Example: The New York Times uses an automated payment reminder system to encourage subscribers to renew their subscriptions. By sending reminders via email and SMS, they increase timely renewals, preventing service interruptions and boosting their revenue collection. You can learn more about their subscription management strategy here.

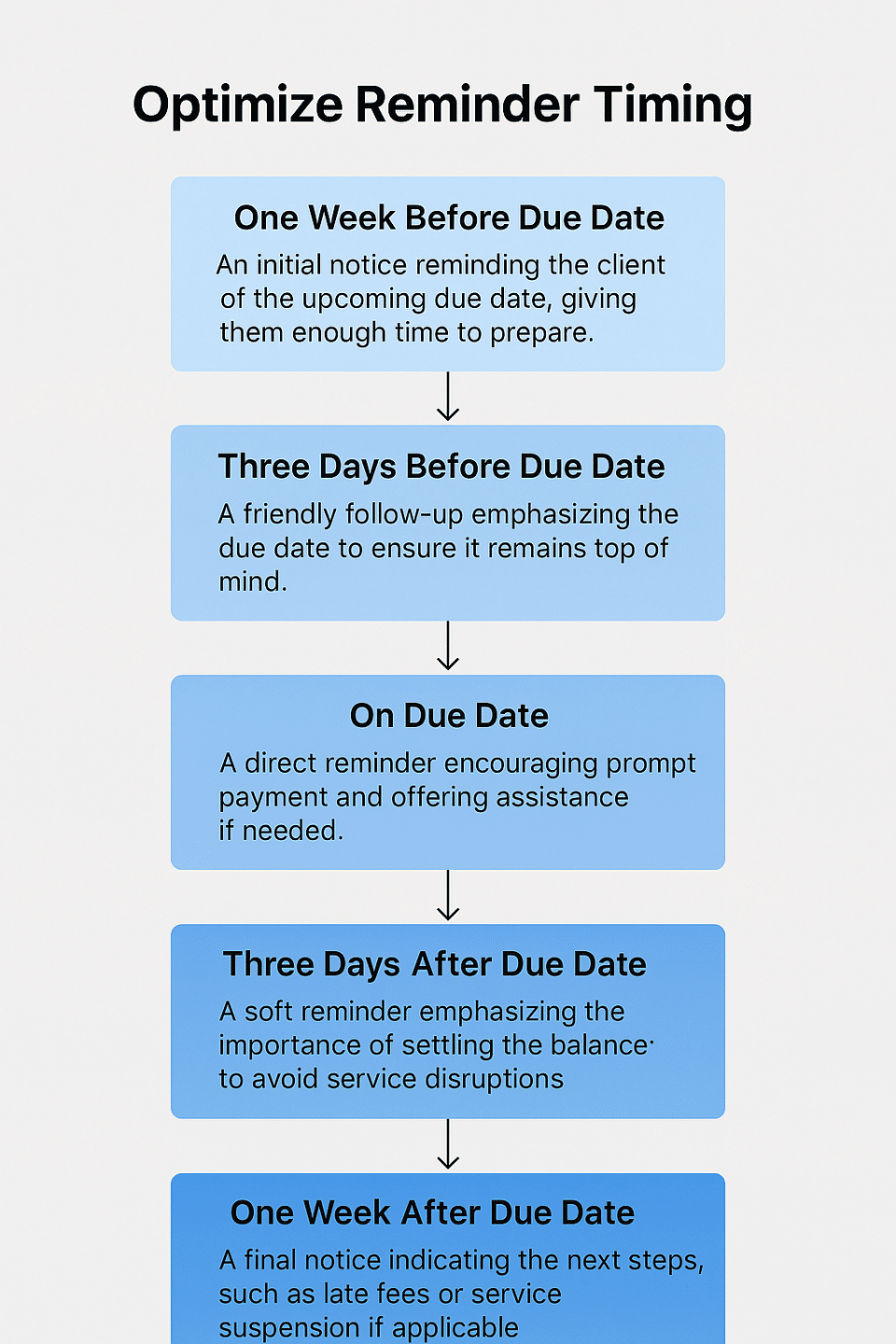

3. Optimize Reminder Timing

To prevent late payments, reminders should be sent strategically at different intervals. A well-timed approach increases response rates and encourages on-time payments. The best practice is to follow this structured schedule:

Consistency and clarity in these reminders help maintain a professional yet effective payment collection process.

Real-World Example: Yoga studios like YogaWorks use automated email systems that schedule reminders based on the user’s payment cycle. These reminders, spaced out over a few days before and after the due date, help maintain a steady cash flow. They also use incentives like discounts for early payments, which you can read more about here.

4. Personalize Your Payment Reminders

Clients and students respond better to personalized messages that acknowledge their specific transactions. Personalization shows professionalism and care, increasing the likelihood of timely responses. A simple approach includes:

- Addressing the recipient by name to make the message feel more direct and engaging.

- Mentioning the specific course or service to provide clarity on what the payment is for.

- Offering a direct payment link for convenience, reducing friction in the payment process.

A polite and structured message like this ensures the recipient has all necessary information while maintaining a professional tone.

5. Offer Flexible Payment Options

Providing multiple payment methods can help eliminate common payment barriers. When clients have convenient options, they are more likely to complete transactions on time. Common payment options include:

- Credit/Debit Cards: A widely preferred method with instant processing.

- Bank Transfers: Ideal for larger transactions and businesses with bank-based billing systems.

- Mobile Payment Apps: Such as PayPal, Google Pay, or Apple Pay, which provide seamless transactions.

- Auto-Debit Subscriptions: Useful for recurring payments, ensuring that dues are settled automatically without manual input.

Flexibility in payment methods can significantly improve collection rates and reduce the chances of missed deadlines.

6. Implement a CRM for Payment Tracking

A CRM system, such as the one offered by Flowclass, helps educators and service providers manage payments efficiently by:

- Keeping track of payment histories, reducing the chances of miscommunication.

- Sending automated receipts immediately upon payment confirmation.

- Offering one-click payment processing, making it easy for clients to settle their dues with minimal effort.

With a CRM, businesses can centralize their financial interactions, improving efficiency and accuracy.

7. Use Friendly and Professional Language

A well-crafted message can influence the way clients perceive payment reminders. The tone should be professional yet friendly to encourage prompt responses without creating pressure.

Example 1: Friendly Reminder Before the Due Date

Subject: Quick Reminder: Payment Due Soon for [Course Name]

Message:

Hi [Client’s Name],

I hope you’re doing well! Just a quick reminder that your payment for [Course Name] is due on [Due Date]. If you have any questions or need assistance, don’t hesitate to reach out. We’re here to help!

Thank you for your continued trust in us.

Best regards,

[Your Name]

[Your Contact Information]

Example 2: Gentle Overdue Reminder (First Follow-Up)

Subject: Friendly Reminder: Payment for [Course Name]

Message:

Hello [Client’s Name],

I hope all is well! We noticed that the payment for [Course Name] was due on [Due Date], and we kindly ask that you settle the balance at your earliest convenience. If you’ve already made the payment, please disregard this reminder. If you need any help or need to discuss payment options, feel free to reach out.

Thanks so much for your attention to this!

Best regards,

[Your Name]

[Your Contact Information]

Example 3: Final Reminder for Overdue Payment

Subject: Last Reminder: Payment Due for [Course Name]

Message:

Dear [Client’s Name],

We hope you’re doing well! This is a final reminder regarding your payment for [Course Name] due on [Due Date]. Please ensure payment is made by [Final Due Date] to avoid any disruption in services. If you’ve already paid, please let us know.

If you need assistance or wish to discuss payment options, we’re happy to help. Thank you for your cooperation!

Best regards,

[Your Name]

[Your Contact Information]

Example 4: Friendly Payment Confirmation

Subject: Payment Received – Thank You!

Message:

Hi [Client’s Name],

We wanted to let you know that we’ve received your payment for [Course Name]. Thank you for processing it! If you need any further details or assistance, we’re here to help.

We appreciate your timely payment and your continued support.

Best regards,

[Your Name]

[Your Contact Information]

Example 5: Gentle Subscription Renewal Reminder

Subject: Friendly Reminder: Your Subscription Renewal is Coming Up

Message:

Hello [Client’s Name],

Just a friendly reminder that your subscription for [Course Name] will renew on [Renewal Date]. If you need to update any details or have any questions, please don’t hesitate to reach out to us.

Thanks so much for being a part of [Your Business Name].

Warm regards,

[Your Name]

[Your Contact Information]

Example 6: Polite Payment Follow-Up After a Few Days of Non-Payment

Subject: Friendly Reminder: Payment Due for [Course Name]

Message:

Hi [Client’s Name],

I hope everything’s going well! We noticed that your payment for [Course Name] was due on [Due Date], and we just wanted to gently remind you to complete the payment at your earliest convenience. If you’ve already paid, thank you, and please disregard this message.

We’re here to assist with any questions or if you need any help with the payment process.

Thank you again!

Best regards,

[Your Name]

[Your Contact Information]

This approach keeps communication open while maintaining respect and professionalism.

How Flowclass Enhances Payment Reminders

Flowclass provides an all-in-one solution for educators, NGOs, and service-based businesses, making payment reminders effortless. Our system offers:

- Automated multi-channel payment reminders, ensuring no payment is overlooked.

- Student and client CRM for one-click payment tracking, reducing administrative workload.

- Event check-in with QR code registrations, making event management seamless.

- Workflow automation for educational and service-based businesses, allowing organizations to focus on growth and service delivery.

With Flowclass, payment collection becomes a hassle-free experience, improving overall operational efficiency.

Conclusion

Implementing a structured payment reminder system helps course creators, teachers, and service-based business owners maintain financial stability while ensuring students and clients make timely payments. By leveraging automation tools like Flowclass, businesses can streamline payment collection, reduce administrative burdens, and focus more on their core services.

Using these best practices, you can enhance your payment reminder system, improve student and client engagement, and optimize your business operations for long-term success. A proactive approach to payment reminders not only secures revenue but also fosters trust and reliability among clients and students alike.